2022 HRD Tuition and Fee Waiver Guidelines

NUMBERED MEMO CC22-024

TO: Senior Continuing Education Administrators

HRD Directors/Coordinators

FROM: Nate Humphrey

Associate Vice President, Workforce and Continuing Education Programs

SUBJECT: 2022 HRD Tuition and Fee Waiver Guidelines

DATE: March 25, 2022

Per N.C. General Statutes (G.S. 115D-5(b)(13)), individuals enrolling in courses offered through the Human

Resources Development (HRD) Program may be granted a waiver of registration fees if they meet one of

four criteria:

1) Are unemployed;

2) Have received notification of pending layoff;

3) Are working and are eligible for the federal earned income tax credit;

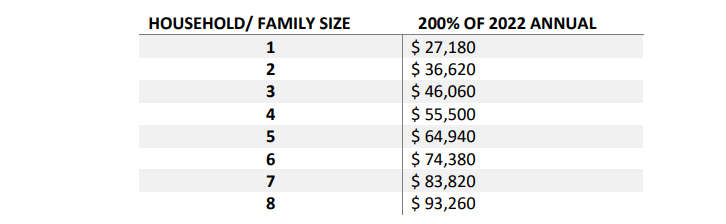

4) Are working and earning wages at or below two hundred percent (200%) of the federal poverty

guidelines.

Federal Earned Income Tax Credit

https://www.irs.gov/credits-deductions/individuals/earned-income-tax-credit/earned-income-taxcredit-income-limits-and-maximum-credit-amounts

Federal Poverty Guidelines

https://aspe.hhs.gov/poverty-guidelines

https://aspe.hhs.gov/system/files/aspe-files/107166/2021-percentage-poverty-tool.xlsx

Use these guidelines for determining an individual’s eligibility for the HRD Tuition and Fee Waiver.

Additionally, the policy states that students for whom registration fees are waived must sign a statement

on an official college document verifying that they meet one of the criteria.

Please note that students must sign a waiver for each course they are enrolled in and seek waiver

eligibility.

If you have any questions, please contact me at humphreyn@nccommunitycolleges.edu or call

919-807-7159.

cc:

Chief Academic Officers

College Registrars

Continuing Education Registrars

Data Coordinators

Institutional Researchers (Planners)

memo_cc22-024_2022_hrd_tuition_and_fee_waiver_guidelines_lb_-_edits_002.pdf